A credit score uses historical information about a person’s past use of credit to calculate the likelihood that they will pay back what they owe on time and in full. Ranging from a low of 300 to a high of 850 (sometimes referred to as “perfect credit”), credit scores are calculated based on payment history, amount owed, length of credit history, types of credit used, and new applications for credit.In general, a score of 660 and above would make a borrower eligible for credit with favorable interest rates. A score below 600 may result in difficulty getting approved for credit and is likely to be subject to high-interest rates.If you don’t know your credit score, you can contact one of the three major credit bureaus; Equifax, Experian or Transunion.

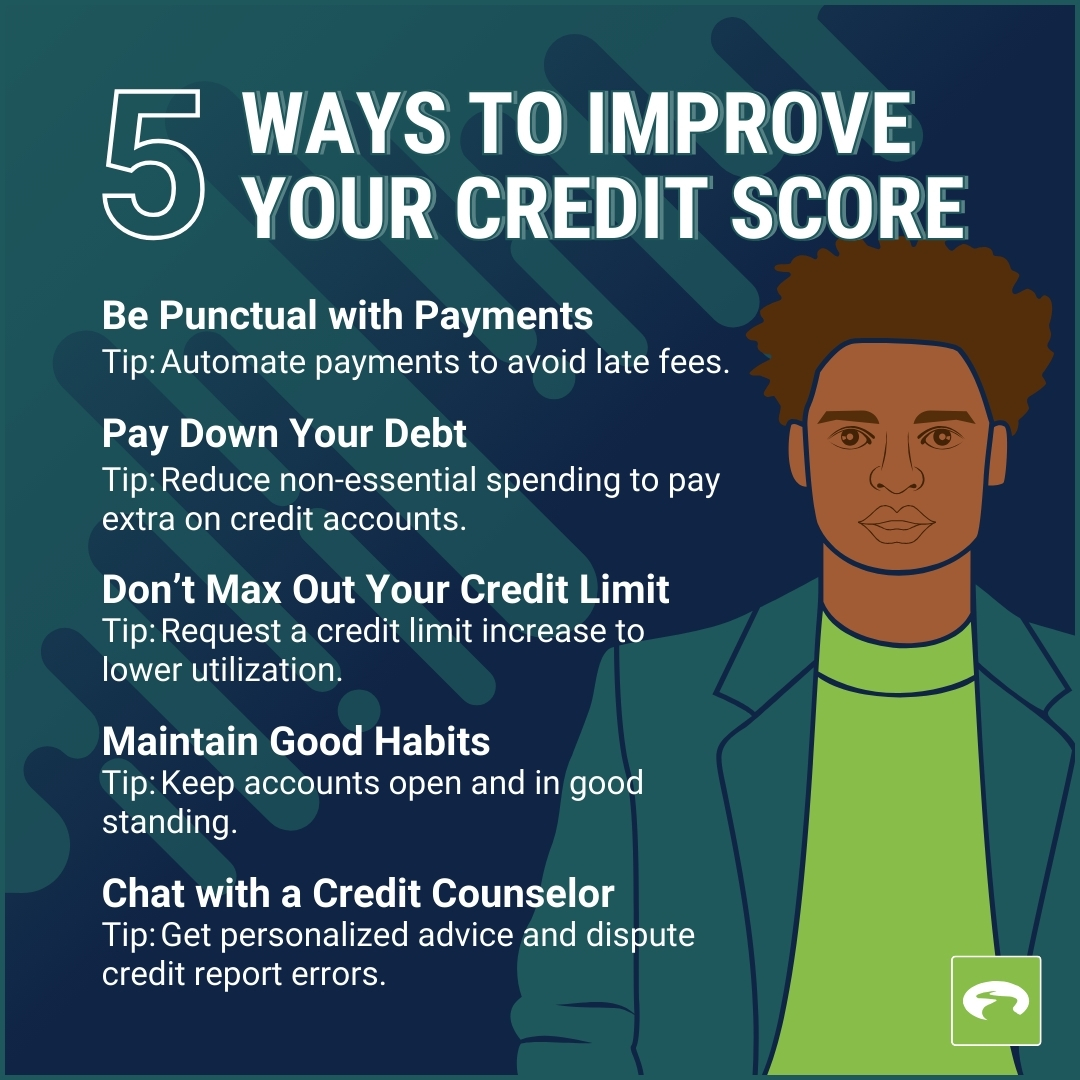

1. Be punctual with payments

2. Pay down your debt

How much you owe is another big factor when it comes to credit score calculation. If you have a large amount of debt or are carrying balances on credit accounts for extended periods of time, it can negatively affect your score.Make it a goal to pay down your debt. Take inventory of any categories where you can reduce non-essential spending so that you pay a little extra on your credit accounts. A credit counselor can walk you through different options for dealing with debt and may be able to help you pay it off more quickly.

3. Don’t max out your credit limit

The amount of credit you use (also called credit utilization) also affects your score. Our financial counselors suggest using less than 30 to 40% of your available credit. Spending above that threshold or carrying high balances relative to your credit limit will cause your score to fall. If you are using more of your credit limit than you would like, consider making adjustments in your budget and spending choices to reduce your overall reliance on credit.Keep in mind that regularly utilizing small amounts of credit (and paying it off) will increase your score. People without established credit history typically receive lower credit scores.

4. Maintain good habits

Your credit score is built on patterns over time, with an emphasis on more recent activity. Improving credit and rebuilding a credit score that has fallen will take some patience, but it can be done! Credit scores can and do change. A history of timely payments and accounts that you have held for five years or longer have a positive effect on your credit score. Quickly opening multiple accounts, carrying high balances for a sustained period, or even closing unused accounts have a negative effect on your score. Events like foreclosure and bankruptcy, while they serve an important purpose for those with severe debt, have a significant and lengthy impact on your credit score. (We are not lawyers, and this is not legal advice. If you are considering one of these options, we encourage you to consult a legal professional and to investigate other alternatives as well.)

5. Chat with a credit counselor

While talking to a credit counselor won’t have a direct effect on your credit score, you can gain valuable insight and information. We will work with you to understand your financial situation, explore different options, and make a personalized plan. We can help you review and understand your credit report. If debt is preventing you from making progress, we can help you explore debt management plans and other options that can accelerate your path forward.

.jpg)